Handling money for an international trip can sometimes feel complicated and a bit overwhelming. You’re juggling international transaction fees, wrestling with currency exchange, all while trying to manage your hard earned money safely and securely.

So, what is the best way to travel with money during your next family vacation?

It simply takes planning and a bit of research to get the right cards and setup for your specific situation.

Matt and I found ourselves in a pickle in Egypt once with no access to our funds because we hadn’t set up a sound travel financial system and ended up having to borrow money from fellow travellers. Since then, we’ve taken money on many international trips and have discovered tips and tricks that keep money management easy, simplified and safe.

We understand how confusing and daunting managing money overseas can be, and we’ve been through many experiences where we’ve learned what works and what doesn’t.

In this post, we’ll delve into the best ways to carry and manage your money while travelling, ensuring you avoid the pitfalls we encountered and enjoy a hassle-free, memorable trip.

What is the Best Way to Bring Money on a Trip?

Travelling abroad requires smart money organisation and a good system. I have found that a mix of cards together with a little local currency works for our family as the best way to travel overseas with money.

It’s crucial to reduce fees while you are away, including bank, transaction, exchange, and ATM charges. These can quickly add up, eating into your hard-earned travel budget.

Picking the right selection of cards is key here to avoid hefty international transaction fees, so plan your spending strategy to minimise costs, keeping more funds for fun!

I’ll break these tips down in more detail throughout the post.

Best Way to Travel With Money: Organisation and Systems

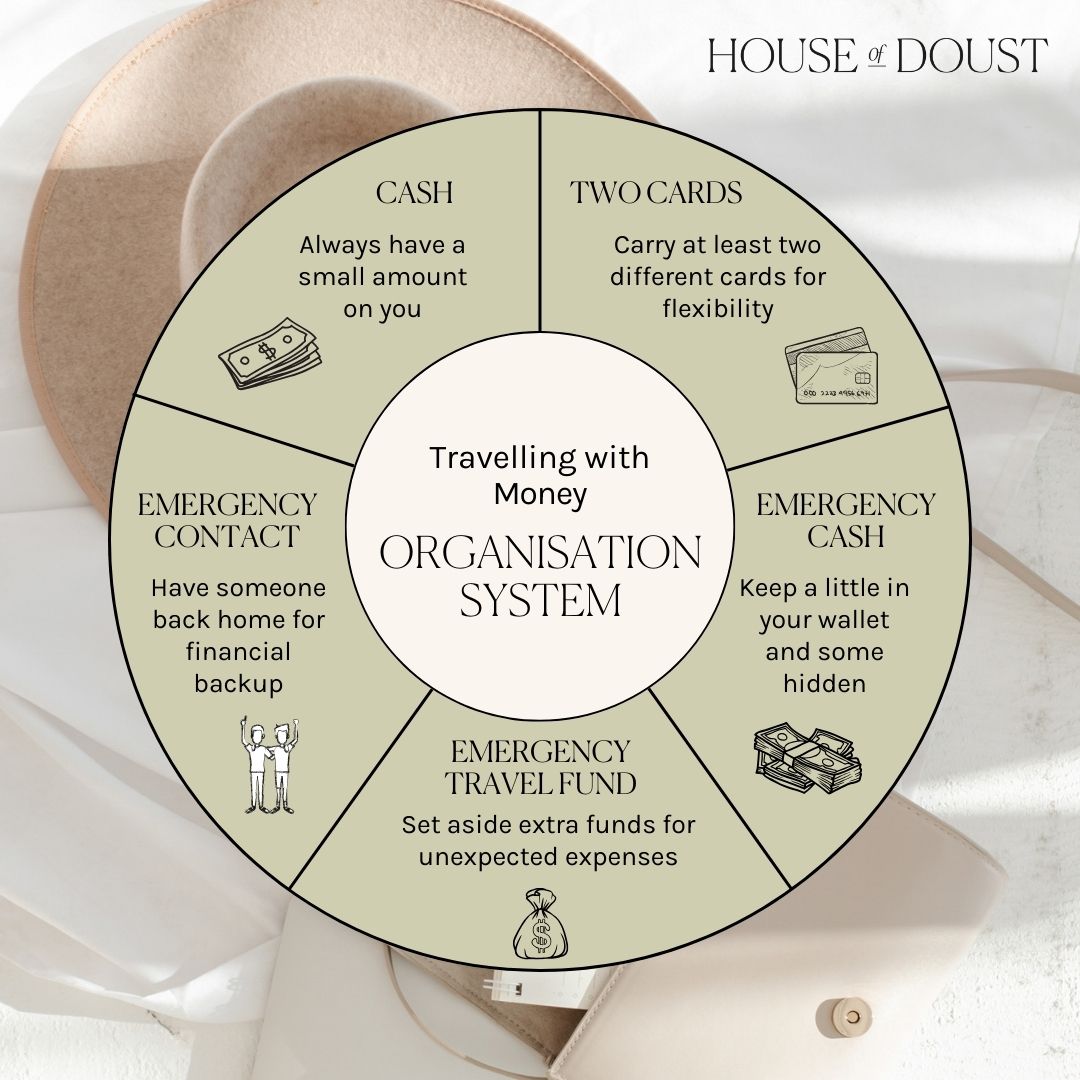

Here’s a simple five-point system that keeps your travel finances efficient and easy to manage:

- Cash: Always have a small amount on you.

- Two Cards: Carry at least two different cards for flexibility.

- Emergency Cash: Keep a little in your wallet and some hidden.

- Emergency Travel Fund: Set aside extra funds for unexpected expenses.

- Emergency Contact: Have someone back home for financial backup.

This particular setup gives you peace of mind and keeps you prepared for anything on your trip. So now let’s break each point of the system down.

How To Travel With Cash Internationally

Cash in Foreign Currency

A little planning ahead goes a long way here. Research exchange rates for your destination currency before you go. And avoid exchanging your cash at the airport if at all possible; they’re costly and stressful, especially when you’re lining up with kids in a busy place.

My best tip is to always carry a small amount of foreign cash on you, especially on travel day. I like to have some on me for those first few hours in a new country where you might need quick snacks or drinks for tired and hungry kids. Or, if plans go south, like a missed airport transfer, you might need cash for a taxi or public transport.

Cards aren’t always accepted everywhere you go, and cash comes in especially handy for specific situations. Think local markets, tipping, or taxis. You never know when you’ll need it.

Cash in Home Currency

It’s a good idea to have a small amount of home currency on you too when you are away.

If you’re not exchanging money before you leave, carry the amount of cash you’re comfortable having on you. You can then exchange it at a good value exchange booth in your destination. You’ll want to do this if you can’t withdraw cash at an ATM because you don’t have a card that’s free from international transaction fees. Just be aware that you will have a large amount of cash on you, so you will want to split it up in case some is stolen or lost.

Can I Still Use Traveller’s Cheques?

Once a safe choice, traveller’s cheques are now outdated. They are hard to cash, rarely accepted, and a hassle to replace if lost. Their exchange rates aren’t competitive either.

In today’s travel scene, they’re more trouble than they’re worth. Credit and debit cards offer more convenience, so stick with the modern alternatives.

Card Options For Overseas Travel

Credit Cards

A credit card is a useful tool to have in your travel belt. Here’s a friendly heads-up though: they’re great, but only if used responsibly. If you know you’re the kind of person that likes a little more ‘cha-ching’, maybe it’s safer to stick with debit cards. You don’t want the post-holiday blues of credit card debt!

Pros:

- Handy for keeping track of purchases

- You can collect rewards and miles

- Generally, you’ll get better exchange rates

- Offers a layer of theft protection

Cons:

- Not accepted everywhere

- Watch out for high interest on cash advances

- It’s easy to get carried away with spending

A crucial tip: choose a card specifically for overseas travel. Look for one with no international transaction fees, low or no ATM fees and good currency conversion fees. This can save a lot of money while you are away.

Backup card: always carry a backup credit card, stored separately from your primary card in case your main card is lost or compromised. This way you know you’ll always have continuous access to funds, which is crucial when managing unexpected situations.

Side note: credit cards are often required for bookings like car rentals and accommodation. They also provide some security and insurance, especially if you need to dispute a charge.

But you guys please, please… always pay off the full balance of your card each month. If that’s tricky, think twice about using credit cards at all. You may even like to try and pay off your balance more frequently on your trip to keep your limit in check.

Do I Need To Activate My Credit Card For Overseas Use?

Check with your bank, but it’s always a good idea to contact them to enable international transactions. This prevents your card from being blocked for suspicious foreign activity, ensuring smooth access to your money while you’re abroad.

Debit Cards

Debit cards are a handy travel addition and a good alternative to credit cards, but also come with their pros and cons.

Pros:

- No credit temptations

- Global cash withdrawal

- Direct purchase payments

- Tracks spending and helps stay within budget

- Fraud protection for lost or stolen cards

Cons:

- Watch for ATM and home bank fees

- Currency conversion charges

- ATM availability varies

- Risk of theft or loss of money in account

- Extra fees at some stores

Tips for Smart Use:

- Limit funds in your account to reduce theft impact

- Transfer money over as needed from a separate account

- Always protect your PIN

- Regularly check your account online for fraud

- Be aware of fees like ATM withdrawals and currency conversions

Consult your bank about the best account type for overseas travel. Remember, ATM fees can be hefty, so use them sparingly or find a card that has no fees. Choose a card with 0% international transaction fees for the best experience.

Can I Use My Debit Card Internationally?

Yes, you can use your debit card overseas, but always check with your bank first. Ensure you notify them you will be using it overseas and be aware of potential fees for foreign transactions and ATM withdrawals. Some banks may have specific restrictions or requirements for international use.

Pre-Paid Travel Cards

Pre-paid travel cards can offer an alternative to credit and debit cards when you are managing your money abroad.

Pros:

- Limited to the loaded amount

- Not linked to bank accounts, adding security

- Helps stick to a budget

- Can lock in favorable exchange rates

- Accepted where Visa/Mastercard is

Cons:

- Can have high transaction and conversion fees

- Exchange rates often less favorable than credit cards

- Reloading can be inconvenient

- Leftover balance post-trip is a hassle

- Watch out for various fees: sign-up, reload, conversion, ATM, cancellation, monthly

Travel cards are an option for those without a credit card or seeking to lock in decent exchange rates. These cards act like debit cards but are pre-loaded with your chosen currency.

Tips for smart use:

- You may want to withdraw enough money for a few days to minimize withdrawal fees

- Always read the fine print to understand the various fees involved and reduce costs

- Load currency onto your card when the exchange rate is particularly good

They can be a useful alternative, especially for multi-country trips with multiple currencies, but may not offer the best value.

Should You Avoid Prepaid Debit Cards?

I wouldn’t say it’s necessary to avoid prepaid debit cards, but just be mindful of their use. They’re great for budgeting and security, yet often come with various fees and restrictions. Assess if their benefits, like fixed spending limits and safety, outweigh potential fees and inconveniences for your specific travel needs.

What Is The Best Way To Take Money Abroad? (Selecting The Right System)

Choosing the right financial organisation system for your family is so helpful when it comes to your travels. It’s not just about convenience, but also about making the most of your travel budget. Here are some tips to help you select the best system for your needs:

- Prioritize Fee-Free Transactions: Look for cards that offers no international transaction or ATM fees. These savings are worth prioritising over reward points or other travel perks. Some cards even waive conversion fees, cash advance fees, and annual fees.

- Carry Multiple Cards: Our family’s travel wallet system includes two credit cards and a backup debit card. The main credit card should have no international transaction fees. The backup credit card is for emergencies, while the debit card is for ATM withdrawals without fees.

- Keep Balances Low: Don’t carry a large balance on any of your debit cards. Keep those hard earned savings in a separate account and transfer funds over to your spending cards as needed. This minimizes the risk in case of theft or loss.

- Unlimited Free Foreign ATM Withdrawals: Choose a card that offers unlimited free foreign ATM withdrawals. If this isn’t available, aim for the lowest fees possible.

- Diversify Card Brands: Carry different card brands like Mastercard, Visa, and AMEX. AMEX isn’t widely accepted everywhere, so having a Mastercard or Visa can cover most of your needs.

- Know Your Spending Habits: Understand your spending patterns and select a system that suits your family’s financial behavior and needs. It’s all about finding the right balance between security, convenience, and cost.

Remember, the best system is one that aligns with your family’s travel style and financial habits. By carefully selecting your travel financial system, you won’t waste time trying to sort out your money while also trying to have a relaxing time with your kids.

10 Safety Tips for Using Your Card While Travelling

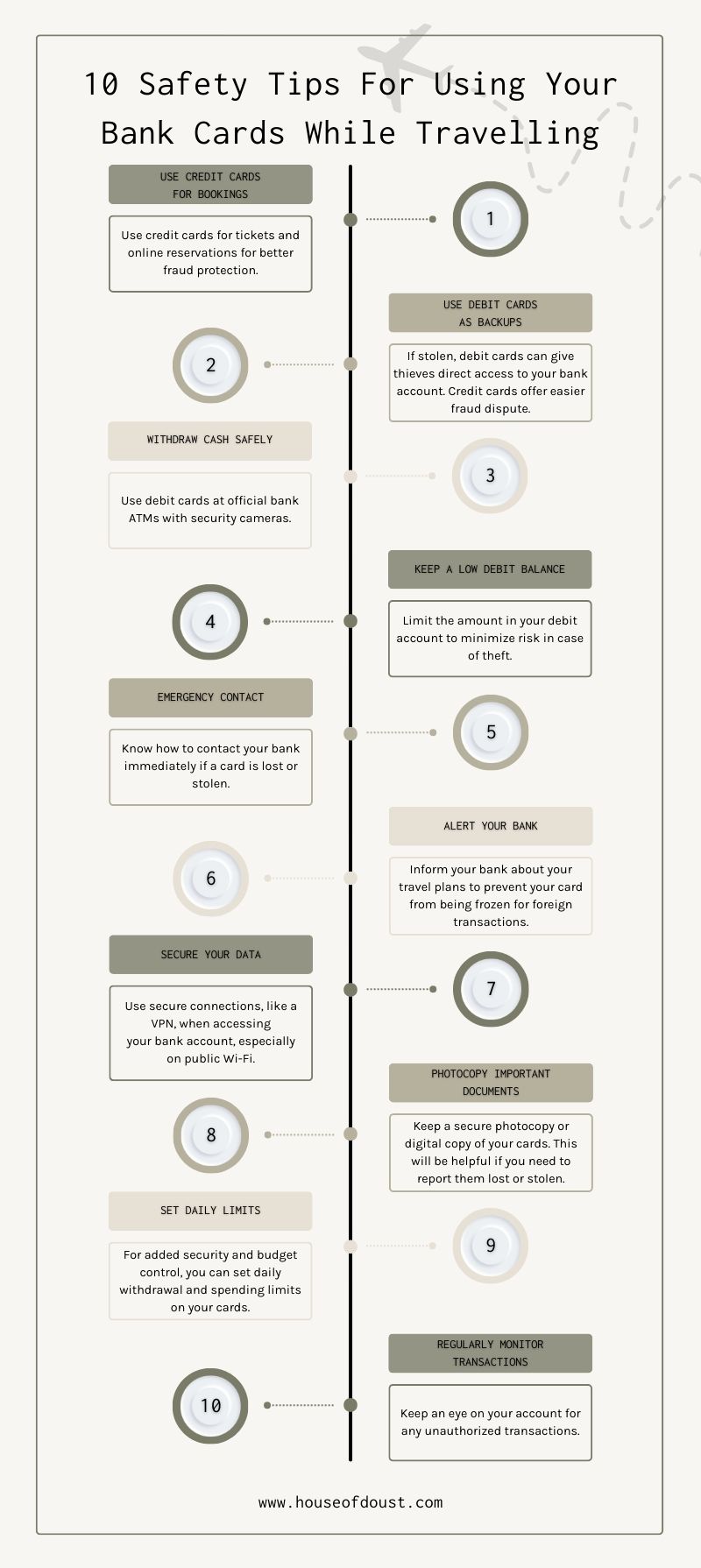

When you’re exploring the world with your family, keeping your finances secure is a top priority. Here’s how to use your cards safely:

1. Credit Cards for Bookings: Use credit cards for tickets and online reservations for better fraud protection.

2. Use Debit Cards as Backups: If stolen, debit cards can give thieves direct access to your bank account. Credit cards offer easier fraud dispute.

3. Withdraw Cash Safely: Use debit cards at official bank ATMs with security cameras.

4. Keep a Low Debit Balance: Limit the amount in your debit account to minimize risk in case of theft.

5. Emergency Contact: Know how to contact your bank immediately if a card is lost or stolen.

6. Alert Your Bank: Inform your bank about your travel plans to prevent your card from being frozen for foreign transactions.

7. Secure Your Data: Use secure connections, like a VPN, when accessing your bank account, especially on public Wi-Fi.

8. Photocopy Important Documents: Keep a secure photocopy or digital copy of your cards. This will be helpful if you need to report them lost or stolen.

9. Set Daily Limits: For added security and budget control, you can set daily withdrawal and spending limits on your cards.

10. Regularly Monitor Transactions: Keep an eye on your account for any unauthorized transactions.

Plan For Financial Emergencies When Travelling Overseas

Always Have A Back-Up Payment Option

In the world of travel, and kids for that matter, the unexpected is often just around the corner. Having a backup payment option is essential to navigate any surprises that come your way. Here’s how to prepare:

- Reserve Cash: Always hide a small amount of local currency on you somewhere. This emergency stash is crucial if you find yourself in a pinch, like needing a quick taxi ride or water.

- Backup Card: A must-have in your travel kit, whether it’s a credit or debit card. This is your lifeline if your primary wallet is lost or stolen.

- Separate Storage: Keep your backup card separate from your main card, in a discreet, small wallet, along with some local cash. This ensures you’re never left stranded without access to funds.

- Multiple Accounts: Setting up multiple debit accounts can be a smart move. They’re generally free and easy to open. Having a few different cards ready for your overseas adventures gives you a safety net and flexibility.

It’s all about being one step ahead my friends!

Set Aside An Emergency Travel Fund

Family vacation preparation requires more than just packing bags and planning itineraries. A crucial aspect often overlooked is setting aside an emergency travel fund in your savings plan.

Here’s what you need to know:

- Unexpected Events: Whether it’s a medical emergency, lost luggage, or last-minute changes in plans, this fund ensures you’re covered without disrupting your travel budget, or while you’re waiting for your travel insurance to pay you back.

- Peace of Mind: Knowing you have a financial backup brings the peace of mind you need to relax on your vacation. Traveling with family means being prepared for the unpredictable.

- Not for Daily Expenses: This fund is not part of your daily travel budget. It’s reserved for serious, unforeseen circumstances only.

- Build Up Over Time: Start building this fund by including it in your savings plan for the trip. Even small contributions can add up and provide significant support in emergencies.

By having this separate emergency fund you safeguard your family, ensuring that unexpected events don’t derail your much-anticipated travel adventures with the kids.

Allocate A Trusted Financial Contact Back Home

When planning a trip, it’s wise to have a trusted contact back home. This person is your financial anchor, holding vital details and ready to assist in emergencies. Here’s why and how to set this up:

- Emergency Funds: Give them access to your emergency fund. They can transfer money over to you if needed.

- Essential Information: Share important details like passport copies and banking information with them. This information is invaluable if you lose important documents or need urgent financial help.

- Keep Them Informed: Ensure they know your travel plans. In case of any mishaps, they’ll be ready to step in swiftly.

Having someone back home who can act on your behalf provides an extra layer of security and peace of mind. They’re not just a financial backup but also a critical support system.

Travelling With Money: The Logistics

Money Exchange

Navigating money exchange for your trip? Here’s what you need to know:

- Airport Exchanges: Avoid them if you can. They’re costly because they’re convenient.

- Exchange at Destination: For better rates, exchange your home currency in the destination country, but again, not at the airport.

- Carry Small Local Cash: Bring a small amount on day one for initial expenses like taxis or snacks.

- Credit Card with No Fees: Use it for its favorable exchange rates.

- Choose Local Currency on Card: When paying by card, if you have the option to pay in home currency or local currency, opt for local currency to avoid higher conversion rates.

- Shop Around: Compare fees and exchange rates and be wary of hidden commissions.

- Order Online Beforehand: Consider ordering currency online for competitive rates and convenience.

Remember, don’t exchange all your money at once to avoid re-exchange fees if you don’t spend it all. With some smart planning, you can ensure you get the best value and keep your travel budget in check.

Using ATM’s Abroad

Minimise Fees For Exchanging Or Withdrawing Cash

When using ATMs abroad, being savvy can save you money:

- Withdraw Smartly: Avoid daily withdrawals to minimize fees. Take out a comfortable amount and store it safely in multiple spots.

- Choose Local Currency: Always select the local currency option at ATMs and shops for the best rates.

- Chip and PIN: Use cards with a chip and a 4-digit PIN. Some ATM machines don’t have a zero button, so change your pin if it has a zero in it.

- Bank ATMs: Use ATMs attached to banks during business hours for added security and immediate assistance if needed (like your card gets chewed up).

- Cover Your PIN: Shield your PIN entry from hidden cameras.

Know Your Withdrawal Capacities And Limits

Using ATMs abroad requires smart planning:

- Know Your Limits: Check if your cards have daily or weekly withdrawal limits. Adjust them based on your travel needs.

- Manage Spending: Overseas, it’s easy to hit your limit without realizing it. Keep track of your spending.

- Safety First: Set a lower withdrawal limit for security. If your card is stolen, this minimizes potential losses.

- Be Prepared: A declined withdrawal can be a hassle. Plan your finances to avoid this inconvenience.

Understand The Rules Regarding Carrying Money Overseas And Through Borders

When entering a country carrying a large amount of cash, make sure you’re aware of the rules:

- Customs Forms: You might need to declare large amounts of cash on customs forms.

- Check Limits: Each country has its own cash-carrying limits. Exceeding these can complicate your arrival.

- Research Beforehand: Always check the embassy or consulate’s website of the country you’re visiting. They provide the necessary guidelines.

- Stay Informed: Being aware of these rules helps avoid any issues at borders.

Taking Money Overseas: How To Manage It

Understand Local Money Customs And Culture

Adapting to local money customs is a key part of everyday travel overseas. Each destination has its own financial culture, impacting how you’ll manage your money while you’re there:

- Cash-Heavy Societies: In countries where cash is king, carrying various bills and coins is going to be essential. Think about local markets, taxis, and small eateries that often prefer or only accept cash.

- Card-Friendly Destinations: If you’re in a destination where swiping plastic is a more popular option, ensure your card is widely accepted. An international transaction fee-free card is absolutely essential in this case, saving you money with each tap at the register.

In addition to researching local payment methods, it’s also wise to get to grips with things like tipping customs and bargaining. In some places tipping is expected, while in others it can be seen as offensive. The same goes for bargaining.

Break Up Your Money Into Manageable Amounts

Managing your cash effectively will help you stay on budget and keep it as safe as possible. Here’s an approach I recommend and use myself:

- Divide and Conquer: Organize your cash into predetermined amounts, like $100 or $200 bundles. You can then use each bundle as your daily spending limit, like allocating $100 for food each day.

- Organization Tools: Keep these cash bundles organized and tidy with elastic bands or paper clips.

- Safe Distribution: Spread out your bundles into multiple different locations — some in your wallet, some in a secure pocket of your backpack, and maybe find a hidden compartment in your suitcase or hotel room. This way, if you lose a portion, it’s not the entire amount.

Tips:

- Daily Envelopes: Try envelopes of cash for each day. They help track spending.

- Emergency Cash: Keep a hidden stash close by for surprises.

- Manage Change: Save small bills and coins for small expenses.

- Teach Kids: Involve kids in managing and splitting money. It’s a safe and educational approach.

Get Connected Online When Possible

Ready Access To Online Banking

Before jetting off, make sure you’ve got online banking at your fingertips. It will help you keep tabs on your funds and handling those unexpected situations. And when using foreign ATMs, keep your account numbers handy as nicknames might not show up.

And a little tip: steer clear of public computers for banking and always log out – better safe than sorry!

Keep Bank Phone Numbers Handy

Set up your phone banking before you leave. It’s a vital backup so you can contact your bank, especially if you can’t access online services. So keep the number readily accessible to you throughout your trip.

Prepare And Organise Your Money System Each Morning

Kickstart your mornings with a little money ritual while you’re away. As you’re sipping your coffee and planning the day’s adventures, sort out your cash. Make sure you have enough small bills and coins for the day’s smaller expenses – think coffee, snacks, and bus fares. It’s all about being ready for those little moments.

Then, for the larger notes, find a couple of safe spots to stash them away. Maybe tuck some in a hidden compartment of your bag, and some in a safe spot in your room. This way, you’re not only prepped with the right amount for the day’s spending but also keeping the bulk of your cash safe.

With this tiny little habit, you’re setting the tone for a well-organized, stress-free day of exploring with your family.

What Is The Safest Way To Carry Money While Traveling?

Ever thought, “What if my wallet gets stolen?” Well, the trick is to have a backup ready to go. Stash some extra cash and a spare card in different spots or with one parent each. Especially with kids, you can’t have mealtime waiting on money woes. So, always keep that plan B (and C!) in your pocket.

Best Ways To Carry Cash Safely While Travelling

Wondering how to carry money safely while travelling? Here are three top tips to keep it safe on your travels:

- Smart Wallet Placement: Ditch the back pocket or purse for your wallet. It’s too obvious and easy for pickpockets. Try a front pocket or a hidden money belt instead.

- Divide Your Cash: Don’t put all your cash in one spot. Split it up. Some in your wallet, some in a hidden compartment in your bag, and maybe even a little tucked away in your shoe or with another person.

- Small Bills Accessible: Keep smaller bills within easy reach for everyday expenses. This avoids flashing large amounts of cash in public, which can attract unwanted attention.

It’s all about being smart and a bit savvy with where and how you carry your money.

How To Hide Money And Valuables While Travelling

Keeping your valuables safe while on the move is crucial. Here’s how to do it:

- Tracking Devices: Equip your luggage with devices like AirTags. They offer peace of mind, allowing you to track your belongings if they get misplaced or stolen.

- Savvy Luggage Choices: Opt for carry-on and checked luggage with built-in safeguards like combination locks and sturdy construction.

- Body Hiding Spots: Get creative with hiding things on your body. A money belt or travel clothing with hidden pockets is one of the best ways to carry a passport or money when traveling.

- Room Safety: Make use of hotel room safes for storing valuables when you’re out exploring. If there’s no safe, hide items in unexpected places in your room, like inside a sock in your suitcase or tucked in a hidden compartment of your bag.

Travelling With Money Overseas: FAQs

Is It Smart To Carry Cash?

Carrying cash overseas is generally a good idea, but it can all depend on your destination and spending habits. Cash is essential in cash-heavy societies and for small purchases. However, for safety and convenience, it’s wise to balance cash with card, especially in digital-friendly destinations. Always have a mix for flexibility.

How Do You Carry Cash On A Trip?

The best way to carry cash when traveling is by dividing it into manageable amounts and distributing it in various secure spots. Use hidden pockets, money belts, or neck wallets for larger bills and keep a small amount in your wallet for daily expenses. This method is the safest way to carry cash abroad as it balances accessibility and security, ensuring you have enough for your needs while minimizing loss or theft risks.

Should You Always Carry Cash On You?

It’s generally a good idea to carry some cash on you during a trip. Cash is useful for small, immediate expenses like tips, taxis, or places that don’t accept cards. However, the amount depends on your destination and planned activities. Always balance carrying cash abroad with safety considerations.

How Much Cash Should You Carry On A Trip?

The amount of cash to carry on a trip depends on your destination and planned activities. Aim for enough to cover a day’s expenses, like meals and transport, but not so much that it becomes a security risk. Adjust this amount based on the availability of ATMs and card acceptance in your destination.

Is It Better To Carry Cash Or Card When Traveling?

The best way to carry money abroad depends on your destination. Cash is essential in areas where cards are less accepted, while cards offer convenience and security in more developed regions. Ideally, carry a mix of both to cover different situations and ensure financial flexibility.

How Do You Carry Large Amounts Of Cash?

Carry large amounts of cash discreetly and securely. The best way to carry money while traveling is to divide it into smaller bundles and distribute it in various hidden spots on your person, such as in a money belt, hidden travel wallet, or secure pockets. Never keep all your cash in one place to mitigate the risk of loss or theft.

Should I Put Cash In My Suitcase?

It’s not advisable to put cash in your suitcase, especially if it’s checked luggage, as it’s vulnerable to theft. If you need to store cash in your luggage, place it in a hidden compartment in your carry-on and keep it with you at all times.

What Is The Safest Way To Fly With Cash?

The safest way to fly with cash is to keep it on your person in a secure and discreet manner, such as in a money belt or a hidden travel wallet. Avoid keeping large sums in checked luggage and be mindful of customs regulations regarding the amount of cash you can legally carry.

Should I Exchange Money Before I Travel?

It’s a good idea to exchange a small amount of money before you travel for immediate expenses upon arrival. However, for better exchange rates, consider exchanging the majority of your money at your destination, avoiding airport exchanges which often have higher rates.

Should You Bring A Debit Card On A Trip?

Bringing a debit card on your trip is advisable as it offers a convenient way to withdraw local currency from ATMs. However, be aware of potential fees and ensure your card is accepted in the destination. It’s also wise to have a backup payment option.

What Are The Disadvantages Of A Travel Card?

Disadvantages of a travel card include potential fees for transactions, currency conversions, and reloading. Exchange rates may not be as favorable as with credit cards, and some travel cards have restrictions on which currencies can be loaded. Additionally, they might not be accepted everywhere, similar to credit cards.

Can I Use My Regular Bank Cards Overseas?

Using regular bank cards overseas is possible, but check with your bank first. Be aware of international transaction fees and whether your card is widely accepted at your destination. Also, ensure it’s activated for international use to avoid any inconvenient blocks on your card.

Is It Safe To Use Public Wi-Fi For Banking Transactions?

It’s generally risky to use public Wi-Fi for banking transactions while traveling. Public networks can be insecure, making them vulnerable to cyber threats. For secure transactions, use a VPN or a secure, private internet connection, or wait until you can access a network you trust.

How Can I Protect Myself From Pickpockets?

Protect yourself from pickpockets by being vigilant in crowded places. Use anti-theft bags, wear travel belts to conceal money, have a dummy wallet accessible, and avoid displaying large amounts of cash. Always keep your belongings in secure, closed compartments and be aware of your surroundings, especially in tourist-heavy areas.

What Should I Do If My Wallet Gets Stolen While Travelling?

If your wallet gets stolen while travelling, immediately contact your bank to block your cards. Report the theft to the local police and obtain a report for insurance purposes. Use your backup cash or cards and reach out to your emergency contact back home if necessary.

How Much Emergency Cash Should I Carry?

Carry enough emergency cash to cover essentials for a day or two, like food, transport, or an unplanned night’s stay. The exact amount depends on your destination and the cost of living there. Keep this cash separate from your daily spending money.

What’s The Best Way To Monitor Spending While Travelling?

The best way to monitor spending while travelling is to use banking apps that track transactions in real time. Set daily or weekly budget limits and review your expenses regularly. Keeping a simple travel diary of expenses can also be a practical way to stay on budget.

Wrapping It Up: What Is The Best Way To Bring Money On A Trip?

Remember, the best way to travel with money involves thoughtful planning and research. It’s about setting yourself up so that if your wallet goes missing, you can bounce back quickly, especially when travelling with kids who can’t just “skip a meal.

I hope I’ve made it clear how vital a robust financial system is when travelling, and also how to make your money management overseas both easy and simplified.

Ready to take the next step in your travel planning? Dive into our post on creating a family travel budget. It’s packed with practical advice to help you plan a fantastic, budget-friendly adventure that your family will cherish.

Financial Disclaimer: Please be aware, we are not financial advisors and the information provided on this blog is not intended to be personal financial advice. Our aim is to share experiences and insights for informational purposes only. We urge you to conduct your own research and consult with your own financial institutions to determine the best financial products for your specific needs. It is important to make informed decisions based on your own circumstances and financial goals.

Rachel Doust is the founder of House of Doust, where she shares practical tips on family travel and smart budgeting for parents who want meaningful adventures without financial stress. A mum of four and a lifelong traveller, Rachel has a heart for helping parents feel more confident about travel and money through honest advice, real-life experience, and easy-to-use resources. When she’s not on the road, she’s busy creating tools that make trip planning simpler for busy families.

love this post? share it!